An interactive presentation system combines the simplicity of a whiteboard with the power of a computer so a teacher or business person can deliver dynamic lessons or presentations and annotate in realtime. Students or audience members can interact with the system, making it a focal point for collaborative learning or working, especially with the advent of multi-touch technology enabling several people to use it simultaneously.

Interactive displays

The key component of an interactive presentation system is an interactive display, usually either a flat-panel display or an interactive whiteboard (IWB). IWBs contain a short-throw projector that projects content from a connected computer on to a touch-sensitive surface.

Interactive flat panels are large, touch-sensitive screens that display content from a computer or media player which may be built-in via an OPS slot. Traditionally they have used optical sensing technology, but infrared is starting to replace this as it copes better with bright ambient light and requires less maintenance.

Flat panels and IWBs do essentially the same job, so one or more users can interact simultaneously with specialist, interactive software bundled with the device or bought separately. The display may be controlled with a separate panel or via the teacher/presenter’s tablet or smartphone.

As flat panel prices fall 55-65in is becoming the entry-level size, with up to 98in now becoming available. HD resolution is the norm and 4K Ultra HD is becoming common for large displays (84in and over); however, availability of 4K content is limited, and viewers may not notice much difference on any but the largest displays. Toughened glass can increase durability in challenging environments such as schools, while displays made of thin, zero-parallax glass that promises more accuracy of touch are starting to appear.

Multi-touch functionality, enabling several people to touch the screen at once, is becoming popular: anything from 10 to 60 simultaneous touches is possible, although for most applications four to eight is sufficient. Motion sensors and voice-activated operation will also become available in 2015.

Software is increasingly becoming a point of differentiation for vendors, with features including creation and playback of lessons and presentations, in-session collaboration, handwriting recognition and the ability to save annotations. Optional extras can include video conferencing integration, BYOD (bring your own device) support, and integration with visualisers and audience response systems.

Loudspeakers are often built-in, otherwise external, USB models can be used. Some interactive displays also have integrated webcams to enable remote participation, and network connectors so they can be controlled remotely.

IWB vs flat panel

IWBs still account for much of the installed base, and generally remain cheaper than large-format flat panels. However, they are rapidly losing market share to flat panels which overtook them in sales in 2014. Flat panels’ back-lit LED technology lasts longer, uses up to 90 per cent less energy, and generates less waste heat so there is no noisy fan and no dust filter to maintain. Image quality tends to be sharper and brighter, and there are no issues with a projected image being obstructed.

Flat panels also tend to be slimmer and neater than IWBs, easier to install and seldom require expert calibration (either on installation or during use). Best of all they have no expensive lamp to fail and need replacement, so both downtime and ownership costs can be considerably lower.

Who is buying?

The main purchasers of interactive presentation systems are schools, with up to 90 per cent penetration in the most saturated markets, such as the UK. Higher education offers more potential for sellers, and many school IWBs are being replaced with smaller, cheaper-to-run flat panels as image quality improves and purchase costs fall.

Businesses are also starting to take a serious interest, as their employees become more au fait with touch technology and costs continue to fall. Sectors range from government and healthcare to technology, manufacturing, pharmaceuticals, finance, retail and even churches.

Training and meetings are the most popular applications, but presentations and events are gaining ground. Buyers’ priorities can differ significantly, however. Businesses tend to want simplicity and rich features, while schools are more concerned about durability and the quality of the interactive experience.

Specification and implementation

Reliability and availability are critical for most buyers, since lessons or presentations may grind to an embarrassing halt if the technology fails. A good, on-site warranty is therefore de rigueur (schools may opt for five years plus), and displays must be designed for professional, not domestic, use.

Compatibility with software, PCs, portable devices, visualisers, voting systems and other technology (planned or already in use) needs to be verified before purchase. The growing trend towards BYOD may necessitate support for operating systems such as Android, iOS and Windows RT and WP.

Matching the technology to the space requires skill and effort – not just with regard to the size, shape and ambient light levels of the room but also the way the technology will be used. A proper scoping exercise and site survey are therefore recommended. Interactive displays can also be heavy, so they require strong mountings on a solid wall.

User training is often overlooked, and many interactive presentation systems are never used to their full potential because users do not know how. Users need to be briefed beforehand on why the technology is being bought and what it can do, then trained in its operation once installed and provided with ongoing support.

Visualisers

Also called document cameras, visualisers comprise a high-quality digital camera mounted on a movable arm that connects to a computer, projector or interactive display. Small, low-cost, portable models are most common, but more permanent ceiling mounted and ‘platform’ models are available.

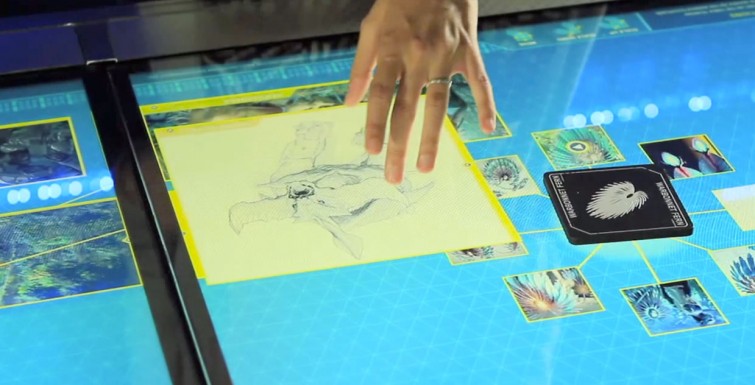

When linked to an interactive display the visualiser gives the audience a close-up view of any object placed in front of the camera. The teacher or presenter may also be able to zoom in and out, spotlight all or part of the image, record and annotate images and video, compare live and recorded images via a split screen, and freeze an image on-screen when the object is removed.

Audience response

A voting or audience response system enables teachers and presenters to ask questions of an entire class or audience and analyse the results – as well as giving the audience something more engaging to do than playing Candy Crush on their phones.

The basic components are some software and a computer to run it on, plus users’ handsets and a base station. Questions may be asked ad hoc or pre-prepared in formats ranging from game shows to exams.

Audience members respond by pressing buttons on handsets. The software can record responses of individual voters – useful for a teacher, say, to judge which students understood the lesson – and produce statistics for the whole group, compiling reports and displaying instant feedback. The functionality of keypads varies widely and extra features such as text displays, memory and microphones can be expensive, so it is important to establish a genuine need.

There is a growing trend to enable audiences to use their own tablets or smartphones via an app, or even to supply them with cheap, disposable units that do not have to be collected in after the event. As an alternative to separate audience response systems, interactive display systems are increasingly able to support collaborative learning and working via BYOD devices.