According to a new market research report “Interactive Display Market by Product (Interactive Kiosk, Whiteboard, Table, Video Wall, Monitor), Application (Retail, Education, Healthcare, Entertainment), Panel-Size (17″ – 32″, 32″- 65″, Above 65″), & Geography – Global Forecast to 2020″, published by MarketsandMarkets, the total interactive display market is expected to reach $14,964.5 Million by 2020, at a CAGR of 12% between 2015 and 2020.

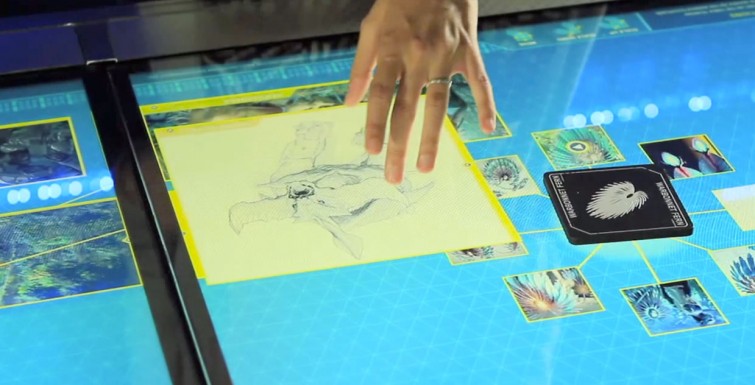

The Interactive Display Market is expected to exhibit high growth in the next five years. There is growing adoption of interactive displays in applications such as retail, hospitality, industrial, healthcare, government/corporate, transportation, education, entertainment, and other applications. The other applications such as residential and, military & defense are using interactive displays to train their personnel.

This report provides a detailed analysis of the overall interactive display market and segments the same on the basis of on product, application, panel size, and geography.

The objective of the research study was to analyze the market trends for each of the industries, growth rates of the various applications (retail, hospitality, industrial, healthcare, government/corporate, transportation, education, entertainment, and others) and the demand comparison of the products in the interactive display market such as interactive kiosks, interactive whiteboards, interactive tables, interactive video walls, and interactive monitors.

Apart from the market segmentation, the report also covers the Porter’s five forces analysis, the market’s value chain with a detailed process flow diagram, and the market dynamics such as drivers, restraints, and opportunities in the overall interactive display market.

This report profiles all major companies involved in the interactive display market such as Samsung Display Co., Ltd. (South Korea), LG Display Co., Ltd. (South Korea), NEC Display Solutions Ltd. (Japan), Elo Touch Solutions, Inc. (U.S.), Planar Systems, Inc. (U.S.), Horizon Display (U.S.), GestureTek, Inc. (Canada), GDS Holdings S.r.l. (Italy), Interactive Touchscreen Solutions, Inc. (U.S.), and Crystal Display Systems (England).

MarketsandMarkets also has a new study, detailing how the global digital signage market is expected to grow at a CAGR of 8.18% between 2015 and 2020, from $14.63 Billion in 2014 to $23.76 Billion in 2020. This report on global market analyzes the digital signage value chain, giving a clear insight into all the major and supporting segments of the industry. The market has been segmented on the basis of type, application, and major geographies (North America, Europe, APAC, and RoW). This report also evaluates market trends and technologies and market dynamics such as drivers, restraints, and opportunities along with the industry’s challenges.

The global market report profiles some of the key technological developments in the recent times. It also profiles some of the leading players in these markets and analyzes their key strategies. The competitive landscape section of the report provides a clear insight into the market share analysis of key industry players.

The major players in global digital signage market include, according to these reports, NEC Display Solutions (Japan), Samsung Electronics Co. Ltd. (South Korea), LG Display Co., Ltd. (South Korea), Sharp Corporation (Japan), Sony Corporation (Japan), Panasonic Corporation (Japan), AU Optronics Corp. (Taiwan.), Planar Systems, Inc. (U.S.), Adflow Networks (Canada), and Omnivex Corporation (Canada).